Blog

- All

- General

- Regulatory News

- Simplifya News

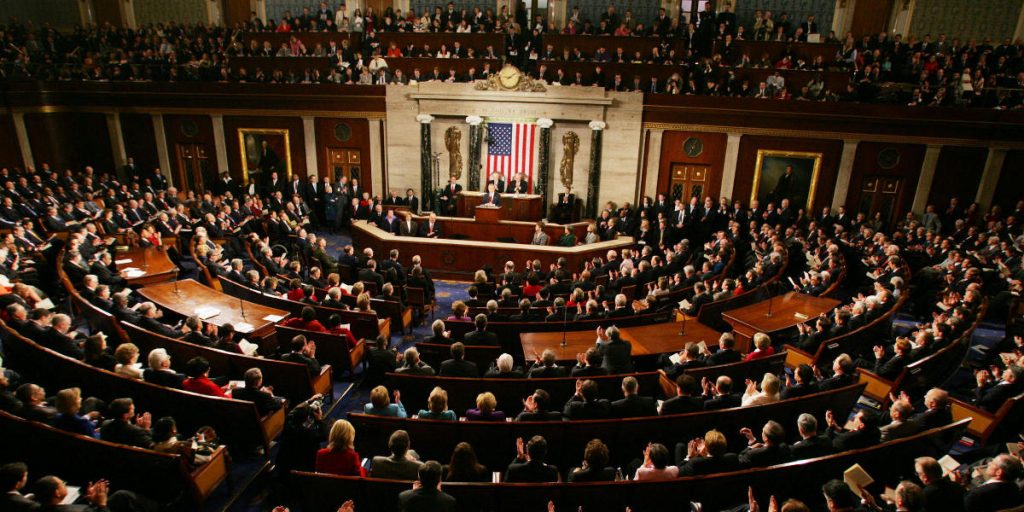

Legal Nerds Talking About Rescheduling

Given our position in the cannabis industry as the leading compliance company, we’re often asked for our thoughts on the recommendation from the Department of Health and Human Services (HHS) to the Drug Enforcement Agency (DEA) that marijuana be reclassified from Schedule I to Schedule III. Honestly, we shy away from questions like this because […]

9 Steps Every New Cannabis Operator Should Follow

You got your license, now what? In partnership with Comploy, we put together a list of 9 steps to help newly licensed operators navigate this highly regulated industry. “It’s our mission to help cannabis operators find their footing in an underserved industry,” Colin Barnard, Director of Marketing at Comploy said. ”We know just how confusing [...]

Cannabis Sustainability: Is Cannabis Environmentally Friendly?

With the constant threat of climate change, both agriculturalists and environmentalists are taking a hard look at the sustainability and environmental impact of the crops they plant, along with cultivation practices. Whether you are a cannabis consumer or are considering venturing into the cannabis industry as a business owner, you may be wondering, “Is cannabis [...]

Cannabis Compliance, a Key to Success for Hispanic Entrepreneurs

Hispanic Heritage Month is upon us! To honor Hispanic entrepreneurs, we would like to revisit the live webinar conducted by the NHCC Legal Committee and Simplifya in June of this year, titled “Cannabis Compliance, a Key to Success to Hispanic Entrepreneurs''. The webinar was hosted by Jerrico Perez from Vicente LLC and a board of [...]

Cannabis Delivery Business: What to Know Before You Get Started

Convenience is key when it comes to selling consumer goods, and cannabis is no exception. If you are considering opening a cannabis delivery business or adding a cannabis delivery component to your existing business, there are plenty of hoops to jump through, but you may be making a valuable investment. Consumers across the U.S. are [...]

4 Ways to Simplify Your Cannabis Compliance Management

Though widespread cannabis legalization began more than a decade ago, in many ways, it still feels like uncharted territory. Cannabis is one of the most heavily regulated industries in the United States, and also one of the fastest growing, valued at approximately $13.2 billion in 2022. For many entrepreneurs, the fear of complex cannabis business [...]

Should Public Cannabis Consumption Be Allowed?

Cannabis users have more options than ever before for where, when, what, and how to consume. Cannabis usage is more popular and socially acceptable than ever before, but why does public consumption of cannabis still seem so far away? The “Gray Area” of Public Cannabis Consumption Legality Despite being illegal almost everywhere in the [...]

Top Five Cannabis Compliance Tips For Retailers

Written by Katelin Edwards and Elisa Cruz. It’s not news to members of the cannabis industry that compliance is key. But between a global pandemic, the economic downturn associated with it, paying federal, state, and local taxes without federal tax deductions or tax credits, and conducting general business operations...where should cannabis retailers focus their cannabis [...]

Top 8 Compliance Tips for Cannabis Businesses

Managing compliance for a business in a highly regulated industry, like cannabis, can seem overwhelming. You have to manage onerous requirements for recordkeeping, reporting, inventory tracking, testing, packaging and labeling, and security systems. The list goes on. You also have to verify that every employee of the company is following the rules, which frequently change. [...]

Prioritizing Cannabis Compliance: Is An Audit Worth The Cost?

Across the country, in 2022 alone the expansion of legal cannabis markets broadened the number of entrepreneurs and businesses entering the cannabis space. East coast states such as New Jersey and Connecticut joined ranks with others and rolled out their recreational programs this year. Whether you’re a cultivator, starting a cannabis business, or have been [...]

The Comeback: How Hispanics are Breaking Back Into Cannabis

Hispanic and Latinx History is American History Although Hispanics and Latinxs are thought to be the same, they are two distinct groups. Hispanic is a term used for people with a background from a Spanish-speaking country. Latinx is a term that refers to people who come from Latin America. Just like the term “Hispanic”, “Latinx'' [...]

Cannabis Delivery Service Compliance by State

Cannabis Delivery Service Compliance Concerns Marijuana delivery services are an emerging subset of the cannabis industry that is rapidly gaining popularity. One of the biggest complications with marijuana delivery services is meeting all cannabis business compliance standards. Business Operations A crucial component of successful marijuana delivery service compliance is having strict operational protocol in place. [...]

Is Ensuring Compliance with Cannabis Rules and Regulations Important for Tamping Down on Illicit Markets?

The policies behind the rules and regulations that govern cannabis programs implemented at the state level often reflect past anti-cannabis biases and, perhaps erroneously, the belief that robust regulation is the only way to transition the industry from illicit-market activities to legitimate marketplace participation. Licensed cannabis operators want to believe that complying with state regulatory [...]

Tri-State Cannabis Market – Growth and Related Regulatory Hurdles

California has received more than its fair share of attention from cannabis industry participants since launching its adult-use program in 2018. However, as California licensed operators struggle to operate in the state’s heavily regulated market that imposes crippling taxes while competing against illicit operators, industry insiders are starting to focus their sights on the tri-state [...]

2022 Simplifya Cannabis Outlook

Working in the cannabis industry sometimes feels like a blur. It seems like just yesterday that states like Colorado and Washington voted to legalize recreational cannabis. Almost ten years later, the U.S. has a maturing nationwide cannabis industry that is experiencing consolidation in certain markets through mergers and acquisitions. This activity has created multi-state operators [...]

The Value of Proactive Cannabis Compliance

Compliance is one of the biggest deterrents to entry into the marijuana industry. For most, it is costly, cumbersome, and confusing. It is also non-negotiable. Medical marijuana is legal in 37 states and the District of Columbia, with legalization under consideration in a handful of other states. Many states have also authorized recreational use. All […]

The U.S. Economic Impact of Cannabis in 2021

In the midst of a global pandemic and economic downturn, legal cannabis is surfacing as a recession-proof industry. The economic impact of cannabis in the United States has increased state tax revenues and created more jobs. It has also impacted real estate prices and progressed social equity. 2021 was a big year for the U.S. […]

5 Predictions For The Cannabis Industry In 2022

It is no secret that the cannabis sector is rapidly growing and evolving. We saw a lot of changes in 2021 - more than what we could have anticipated. So what is 2022 going to be like for cannabis? Here are our 5 predictions: 1. The International Market Will Continue To Expand Cannabis will become [...]

What could the US legalizing marijuana look like?

A map of legalization in North America is looking like a coloring book page that didn’t get finished before arts-and-crafts time ended. And the only section that's yet to be completely filled in by the End-of-Prohibition Crayola is the United States. This is because, in the US, marijuana is still federally illegal. But many think [...]

5 Things You Need to Know When Buying a Cannabis Business

The idea of owning and operating a cannabis dispensary is often romanticized. It’s not as simple as finding a consistent cannabis source and hanging a sign on the door. Nor is it as simple as buying a business with a functioning cash register. In fact, cannabis is one of the most regulated and taxed industries […]

A simple way to estimate cost of compliance

We hear a variety of objections that boil down to some form of “I’ll take my chances.” The statement implies that the cost of compliance with marijuana regulations is greater than the cost of non-compliance, but is that really true? The answer, of course, is that it depends. Cost of Compliance The cost of compliance […]

An Overview of Marijuana Compliance Laws on the East Coast: State-by-State Highlights

California was the first state to legalize medical marijuana. The eastward spread of legalization has been a slow climb, but several states have found ways to implement laws that are friendlier to marijuana users if not legalized. Currently, marijuana is legal for adult recreational use in 18 states as well as Washington, D.C. Medical marijuana […]

How to Ensure Cannabis Compliance to Protect Your Business License

Obtaining a cannabis business license is no walk in the park, regardless of which state you’re a licensed cannabis operator in. Once you have that license, protect it like it’s your baby. In early 2021, a San Francisco area marijuana testing lab filed a lawsuit against the California Bureau of Cannabis Control after the lab’s [...]

Simplifya Makes Major Q2 Moves with closing of $6 Million Series B Round

Simplifya Makes Major Q2 Moves with closing of $6 Million Series B Round, addition of Jeff Katz to Board of Directors and imminent launch of TENDRTM Payment Processing Solution Denver, CO – June 17, 2021 – Simplifya, the leading provider of regulatory and operational compliance software for the cannabis industry, is proud to announce it has [...]

Simplifya’s New Smart Cabinet Has Arrived

There’s a saying that 90% of cannabis compliance is documentation. Keeping files. Organizing files. Making sure none of your documents are expired. Being able to produce them for an inspection at a moment’s notice. Since launching two years ago, Simplifya’s Smart Cabinet has provided our users with an online hub to organize and manage all [...]

Simplifya Aligns with NCRMA as an Exclusive Service Partner to Cannabis Industry Operators

Denver, COLORADO -- April 28, 2021 -- Simplifya, the leading provider of regulatory and operational compliance software for the cannabis industry, is proud to announce that it has joined forces with the National Cannabis Risk Management Association (NCRMA) as an exclusive service partner for NCRMA’s members. Simplifya and NCRMA recognize the value compliance and risk [...]

Simplifya to Launch New Cannabis Payments Platform

Payments industry veteran Jeff Katz, together with Simplifya, will bring leading-edge, compliant payment processing, integrated digital commerce, and loyalty marketing to the cannabis industry Denver, CO – April 1, 2021 – Simplifya, the leading provider of regulatory and operational compliance software for the cannabis industry, is proud to announce it has teamed up with [...]

The Three-Two-ification of Cannabis: Does the Industry Need Potency Caps?

Back in 2012, when Colorado became the first state to legalize recreational/adult-use marijuana, we typically summarized the proposal with a pithy suggestion-- “just regulate marijuana like alcohol.” It didn’t quite shake out that way, because marijuana is decidedly not alcohol, but the argument by analogy certainly convinced voters to approve cannabis reforms in a number [...]

The State of State Cannabis Regulations & Sustainability

When states like Colorado and Washington made history by voting to legalize adult-use cannabis back in 2012, it’s safe to say that environmental sustainability was not at the top of the priority list for state regulators. Even now, when more than half the states in the country have either a medical marijuana or adult-use cannabis [...]

Cannabis Compliance & Sustainability: A Complicated Relationship

There’s no question that compliant, sustainable cannabis operations are the goal of the cannabis industry. Regardless of whether you’re a single location retailer or a multi-state operator, the task of developing and successfully operating a compliant cannabis business that is also sustainability-minded is not a challenge for the weak of heart...or wallet. The relationship between [...]

Hub International Chooses Simplifya For Ongoing Cannabis License Verification Of Cannabis Clients

Simplifya Verified Platform to Deliver Efficient Cannabis License Verification Process for HUB December 3, 2020 - Hub International Limited (HUB), a leading global insurance brokerage, announced today that is has chosen Simplifya, a leading provider of operational and regulatory compliance software for the cannabis industry, to provide ongoing cannabis license verification in order to help [...]

Simplifya, NatureTrak, and HDCS Form Alliance to Deliver a Cannabis Banking Compliance Solution for Financial Institutions

Simplifya, NatureTrak, and HDCS jointly announce a strategic alliance to provide a comprehensive, cost-effective solution to help financial institutions build and maintain compliant and profitable cannabis banking programs. Despite legal cannabis markets in 35 states, and continuing record-breaking sales growth, the financial services industry has been reluctant to bank the industry due to the risks [...]

Simplifya’s Newest Compliance Tools: Cannabis License Tracking & Reporting

As we continue our quest to offer the most efficient, comprehensive compliance tool for the cannabis industry, we are proud to deliver two more tools for your arsenal: Cannabis License Tracking and Reporting. These two new features round out our core software platform and further enable our clients to manage their compliance, their way. One [...]

How to Use Simplifya SOPs to Complete the California BCC Forms

Back in January of 2019, we published a blog post detailing how a licensed retailer or licensed distributor in the state of California can best use Simplifya’s standard operating procedures (SOPs) to help in completing forms issued by California’s Bureau of Cannabis Control (BCC). Since then, we have updated our SOPs to even better aid [...]

Risky Business: Why is Cannabis Insurance so Hard to Get?

If you’re a person like me who is generally aware of… things, then you’ve probably heard about the particularly intense wildfire season we’re experiencing in the Western U.S. You may also be aware of the fact that the Western U.S. is home to a significant portion of the country’s cannabis industry. This is a bad [...]

Kamala Harris’ Switch from Cannabis Legalization to Decriminalization

In her acceptance speech for the Democratic nomination for vice president, Kamala Harris reiterated her call for equal justice and the end of structural racism. In the past year, Harris has swiftly embraced a role as a leader on cannabis legalization emphasizing its effectiveness in achieving these goals. However, with her newly minted status as [...]

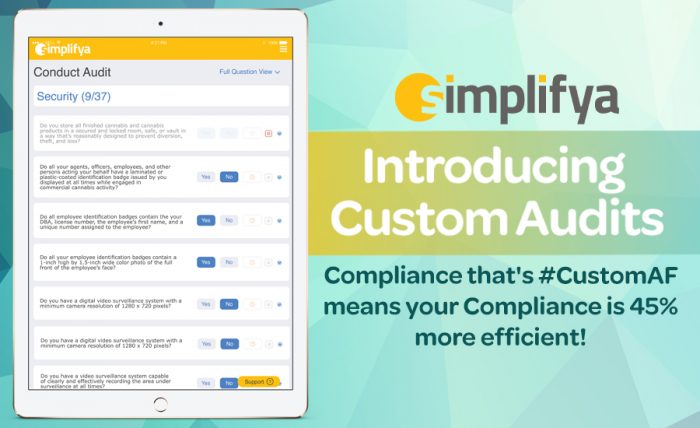

Introducing Simplifya Custom Audits: Audit Your Business Your Way

You asked. We listened. And, now...we’re proud to deliver Custom Audits. After nine months of behind the scenes work, we are proud to unveil a complete overhaul of our Self-Audit tool and present you with our new, and much improved Custom Audits module. We reimagined and reworked this feature from top-to-bottom, resulting in our audit [...]

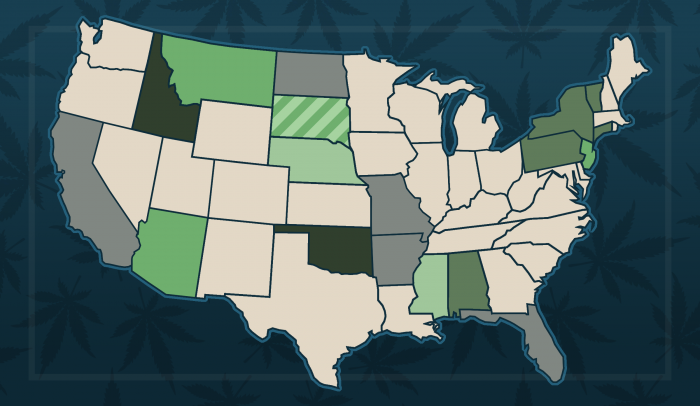

The State of State Initiatives: Marijuana in 2020 curbed by COVID

Written by Tyler Elder and Luke Ewing As we hear every election cycle, the election of 2020 will be the most important election of our time. But what about the importance of this election to the cannabis industry? For a while, it looked like we would have a flood of new states voting on-- and likely [...]

The Next President’s Stance on Cannabis

What will the next president’s stance on cannabis be? As the year progresses, the presidential field narrows: what was once filled with more than a dozen candidates has now been reduced to just a few. Ahead of what will be perhaps one of the most dividing elections we’ll see in our lifetime, we thought that [...]

Shifting Focus: From Social Distancing to Social Equity

From Physical Illness to Societal Ills This post was originally intended to be a follow-up to our previous post about the emergency regulations that were enacted due to the coronavirus epidemic. We were expecting these rules to expire, or at least be modified, after a few months...but here we are, three months later, and the [...]

Cannabis: Regulatory Compliance 101

Cannabis Regulatory Compliance in 2020 Staying on top of your state’s regulatory compliance is important for every licensed operator working in the cannabis industry; especially now, in the age of coronavirus when most states have layered even more stringent emergency regulations on the industry. Our regulatory affairs team recently put together a series of blogs [...]

Simplifya’s Manufacturing SOP Templates are GMP-Compliant

By now, you’ve probably heard the term “GMP,” and know that it refers to “Good Manufacturing Practice,” but what does it really mean, and how does it affect your cannabis manufacturing business? GMP is a widely-accepted system of regulations, designed with consumer safety in mind, to ensure that products are consistently produced in accordance with [...]

Top 7 Cannabis Compliance Tips for Manufacturers

Introducing cannabis to “mainstream” communities and consumers around the world hinges on successfully redefining what people have been taught about the plant, and simultaneously working to break down the stigma of both cannabis, and cannabis users around the world. One of the most influential ways we can do that is through a commitment by cannabis [...]

Social Equity – or Lack Thereof – in the Cannabis Industry

Written by Katelin Edwards, Luke Ewing, & Watson Mulkey The murder of George Floyd has amplified and renewed conversations about race relations in the United States and abroad. While the cannabis industry has been discussing social equity since long before the current unrest, we have not been seeing the results we want. And in a [...]

Top 10 Cannabis Compliance Tips for Cultivators

There’s no doubt that the COVID-19 pandemic has thrown us all for a loop. During times like these, we are all just trying to survive and come out the other side intact. The current crisis has driven individuals and industries to innovate and be more agile. To conserve energy and increase efficiency. To simply stay [...]

The New Normal: Cannabis After Coronavirus

We’re living through stressful and confusing times. Everything is closed, the news is changing every hour, and we’re all stuck at home bored out of our minds. This era of uncertainty could lead to a new normal for cannabis after coronavirus. Luckily, most jurisdictions across the U.S. have allowed both medical and recreational dispensaries (and [...]

Simplifya Closes $1.5 Million in Over-Subscribed Bridge Round; Increases Round to $2.5 Million In Response to Strong Interest from Investors

Denver – April 23, 2020 – Simplifya, the leading provider of regulatory and operational compliance software for the cannabis industry, announced today that it has closed $1.5 million of its currently over-subscribed bridge round. Based on strong interest and preliminary commitments, Simplifya expects to close an additional $1 million as part of the expanded round [...]

Social Distancing Sales: Delivery, Drive-thru, and Pickup

As you may have heard in the news, governments whose stay-at-home orders shuttered millions of businesses nationwide have largely exempted cannabis operators from suffering a similar fate. While some people have expressed skepticism, cannabis is an essential need for millions of patients, whether they have a card or have to rely on recreational/adult-use sources to [...]

Successfully Pivoting Your Company’s 4/20 Plans During Coronavirus

April 20th (or 4/20) is a day cherished by cannabis users around the world as a reason to consume with friends and attend rallies, concerts, and festivals in celebration. What was once a ritual started by a group of high school students in the 1970s has become a mainstream, commercialized holiday, used by cannabis companies [...]

Simplifya and Akerna Collaborate on Integrated Compliance Solutions Provides Operators With Access to Easy-to-Use Compliance and Regulatory Tools

Denver, CO – April 8, 2020 – Denver-based cannabis compliance technology companies, Simplifya, the leading provider of regulatory and operational compliance software for the cannabis industry, and Akerna (Nasdaq: KERN), developer of the cannabis industry’s first seed-to-sale enterprise resource planning (ERP) software technology (MJ Platform®), have entered into a collaboration to deliver integrated compliance and [...]

Puff in The Time of Corona: Emergency Regulations and CDC Audits

If you’re in the cannabis space right now, we’re sure you know that your operating requirements are rapidly and regularly changing-- even day-to-day. Leafly is doing a great job of keeping up on which states are allowing dispensaries to stay open and which ones are allowed to deliver. But most governments are doing much more [...]

Coronavirus, Essential Businesses, and the Cannabis Industry

Last updated 7/09/20 Are dispensaries considered essential businesses during the coronavirus pandemic? During the current coronavirus or COVID-19 pandemic, many government agencies have implemented stay-at-home or “Shelter in Place” orders, and are only allowing essential businesses to stay open. As part of those orders, some initially categorized cannabis and dispensaries as non-essential, but quickly reversed [...]

Simplifya Talks Cannabis Policy – Our Experience Sponsoring Denver’s 2020 Growth Conference

On March 5 and 6, Simplifya was proud to sponsor a policy conference in Denver, and it was well worth the money! In attendance were: CEOs, lawyers, branding specialists, chemists, master growers, regulators, Legislators, GOVERNO-- okay Jared Polis was supposed to come but he had to cancel in order to announce the first Colorado cases [...]

Veteran Sales Executive Scott Daly Joins Simplifya as Chief Revenue Officer

Denver – February 27th, 2020 – Simplifya, the leading provider of regulatory and operational compliance software for the cannabis industry, announced today that the Company has appointed veteran sales and finance executive Scott Daly, to the role of Chief Revenue Officer, effective immediately. In this role, Mr. Daly will be responsible for driving innovation and [...]

Client Spotlight: Lindsay Gardner, Silver Stem Fine Cannabis

At Simplifya, we appreciate all the hard work people put into making the cannabis industry grow. Recently, we reached out to a few of our clients to get to know them and their experience in the cannabis space a little better. First up, we spoke to Linsday Gardner, Director of Licensing and Compliance for Silver [...]

Which Presidential Candidates are Cannabis-Friendly?

You may recall that last year, Simplifya released a blog post about the different presidential candidates and their stances on cannabis. Now that the Iowa and New Hampshire Democratic caucuses are behind us, things are really heating up. It’s time for an update about candidates who are still standing and if their stances on cannabis [...]

2020 Cannabis Industry Predictions

If you thought 2019 was a big year for the cannabis movement, wait until you see what’s in store in 2020. As we reflect on what did and what didn’t happen in 2019, and look ahead to our cannabis industry predictions for 2020, we anticipate that cannabis will likely be fully legalized in at least [...]

Simplifya tackles Missouri and New York cannabis regulations

Written by Tyler Elder and Taylor Hart-Bowlan Here at Simplifya, our team of lawyers and regulatory affairs analysts spends a lot of time digging through cannabis regulations, so our clients don’t have to. In 2019 alone we’ve simplified regulatory content for seven states and countless local jurisdictions. But, the year’s not over yet, and neither […]

Status Update for 2019 Cannabis Industry Predictions

Back in December 2018, on behalf of Simplifya, I made three predictions for what we would see happen in the cannabis industry in 2019. Those predictions included that the New York and Illinois state legislatures would legalize recreational cannabis and that the 116th Congress would enact incremental reform to address some of the unique challenges […]

Medicine Man Technologies: Andy Williams Controls the Universe

Medicine Man just went on a $300 million spending spree in a bid to protect Colorado’s cannabis industry. CEO, Andy Williams, sits down to tell us what’s next. Another day, another CannaGather event, another blog post! At Simplifya, we love our local CannaGather events (both sponsoring and attending), because they always draw such big names […]

The Vaping Crisis: Why You Should Care if Your Product is Tested

Doing compliance work in the cannabis industry, we often hear people complain about the rules, regulations, regulatory bodies, and individual regulators governing the industry. “The costs are outrageous,” “these regulations make no sense,” “that Marijuana Enforcement Division Inspector is too strict,” the list goes on. And sometimes, these complaints are valid. Compliance costs are high, […]

Simplifya’s MED Rulemaking Wishlist

As we’ve mentioned before, Colorado is about to usher in some big changes to its regulated cannabis industry. During the last legislative session, Colorado legislators passed bills that: Expanded the qualifying conditions for medical cannabis Legalized deliveries Legalized consumption lounges (also known as hospitality establishments) Took a stab at social equity by creating an accelerator […]

New features in Simplifya helps improve compliance management

Written by Watson Mulkey and Bill Gunnison This summer, Simplifya debuted two new features related to our audit content, as well as a brand new dashboard, that has been redesigned from the ground up to both simplify and enhance the overall user experience. Simplifya now provides users with direct access to the specific laws and […]

Cannabis Banking: The Prospects for Legal Protection

The trend of states legalizing cannabis – 33 states and counting – while it remains illegal under federal law poses a dilemma for U.S. financial institutions. While some banks and credit unions have chosen to serve cannabis businesses, most refuse to do so given the ongoing legal uncertainty. With limited banking access, many cannabis businesses […]

Simplifya Partners with CannGen Insurance Services to Reward Compliant Cannabis License Holders

Denver – Simplifya, the leading provider of regulatory compliance software for the cannabis industry, announced today a partnership with CannGen Insurance Services, the cannabis industry’s leading insurance underwriting facility, to provide licensed cannabis businesses with discounted insurance premiums for qualified operators. “Both Simplifya and CannGen recognize the value that compliance will increasingly provide in the […]

Cannabis Content Kickoff: Arkansas, Illinois and North Dakota!

Just in time for the kickoff of the college and NFL football seasons, Simplifya has kicked off brand new cannabis regulatory and compliance content for the Arkansas, North Dakota and Illinois markets. Just as a helmet and pads protect players from injury risks, Simplifya’s compliance software offerings help operators protect their licenses and business from operational […]

Redesigning Our Compliance Dashboard Just for You

For a lot of tech companies, the amount of time users spend in an application becomes the gold standard metric. With today’s release of our new compliance dashboard, we’re hoping to make it so that our users can spend less time in Simplifya. There’s a famous quote that gets tossed around a lot in Product […]

The Evolution of Simplifya’s Colorado SOP Bundle

Last year, Simplifya’s Colorado SOP (Standard Operating Procedure) bundle consisted of 35 templates that covered important subjects related to cannabis operations. We called this the “generic bundle” because, with the exception of California, the same 35 templates were used for other states. It was a way to quickly create coverage for 14 states. 2019: The […]

Simplifya’s 2019 Mid-Year Cannabis Roundup

It might be hard to believe, but we’re already halfway through the year. So far, 2019 has been a big year for cannabis in the US. Keeping up with the constant change throughout the industry can be exhausting. That’s why I’ve compiled the most important and impactful developments from the first six months of the […]

Simplifya Takes on Detroit at CannaCon Midwest

The atmosphere at CannaCon Midwest was electric this past weekend. The Cobo Center was bustling with Michiganders poised to get in on the state’s sexiest new industry: cannabis. Michigan has had medical cannabis since 2008, but in just a few months the state will begin issuing licenses for recreational cannabis, which is expected to generate […]

Colorado Cannabis Caucus Gives a Peek at the Industry’s Wishlist

On June 11, the National Cannabis Industry Association (NCIA) held their Colorado Cannabis Caucus in Boulder. As a dues-paying member of NCIA, Simplifya was there to represent the regulatory compliance game! There was excellent food (and excellent drinks), but the highlight of the night was hearing from our local government representative, Jonathan Singer, and our […]

Regulatory Expert John Vardaman Joins Simplifya Leadership

Simplifya, the leading provider of regulatory compliance software for the cannabis industry, announced today that banking regulation expert and former senior Department of Justice official John Vardaman will join the company as Chief Compliance Officer and General Counsel on June 17. Mr. Vardaman spent 15 years in senior positions in the U.S. Departments of Treasury […]

Simplifya Meets MED Directors Burack and Mendiola

At Simplifya, we like to get as much face-to-face time as possible with other members of the cannabis industry. On any given night, you can find our team attending rule-making hearings, trade shows, and networking events like Tuesday night’s CannaGather event featuring Marijuana Enforcement Division Director Jim Burack and Deputy Director Dominique Mendiola. We mobilized […]

2019 Cannabis Industry Developments: Tracking Cannabis Bills Part 2

Welcome to my second cannabis industry developments of 2019! In the second legislative roundup of 2019 we’ll look at the most significant cannabis bills that have been introduced in the following states: Colorado, California, Oregon, Nevada, Arizona, Michigan, Florida, Pennsylvania, and Massachusetts. Scroll down to see a summary, the current status (as of 4/11/2019), and […]

Immaculate Conception: The Mystery of Start-up Genetics

Last November, two more states joined the cannabis movement and at least partially did away with their antiquated cannabis laws. Both Missouri and Utah legalized medical cannabis during the midterm elections, although to varying degrees of legality. As I made the pilgrimage home to St. Louis last week for the MoCannBizCon+Expo, I was impressed to […]

Tribes and Cannabis: Federalism is Messy

Today’s “legal” cannabis industry grew out of the cracks in our federalist system (a system where other states or governments operate in addition to the federal government). In the US, we have state government powers and federal government powers. Sometimes they overlap; sometimes they conflict. Cannabis is only legal because the federal government has chosen […]

Cannabis Legalization & The Presidential Campaign: How They Overlap

The 2020 presidential campaign will be a competitive one, with President Donald Trump running for re-election and 535 other candidates (as of February 19, 2019) running against him. Major issues that candidates will be running on include the economy, immigration policy, healthcare, climate change … the usual. But as I read through endless articles about […]

Regulators send message that compliance matters

Knock Knock! Who’s There? Your Licensing Authority. State agencies across the country are revving up cannabis law enforcement efforts, and the number of businesses now bearing the hefty cost of non-compliance is growing as a result. In Different States In just the last month, administrative agencies in Massachusetts, California, and Colorado have all cracked down […]

2019 Cannabis Industry Developments: Tracking Cannabis Bills Part 1

Welcome to Bill’s first legislative roundup of 2019! The 2019 legislative session is only a few weeks old, but plenty of cannabis bills are already on our radar. In the first legislative roundup of 2019, we’ll look at the most significant cannabis bills that have been introduced (so far) in Colorado, California, Oregon, Maryland, Pennsylvania, […]

New CA Regs: What Cannabis Manufacturers Need to Know

After a year of confusion and change, The Golden State has finally adopted permanent regulations for the industry. This is a bittersweet victory for many California operators as they now have a stable set of rules to follow; but many are still left wanting more. And in that same vein, making changes to the new […]

CDFA Regulations: What’s Changing (but mostly what’s not)

Happy 2019, everyone! As the cliche goes: New Year, New Me…Rules. After being notified in early December, it looks like California just approved a new set of cannabis regulations! Effective immediately! So what does this mean for all you Emerald Trianglers and other California growers under the newest CDFA regulations? Not that much, honestly. CDFA regulations: What’s […]

Updated SOP templates address California BCC forms

California’s Bureau of Cannabis Control (BCC) recently announced the release of the proposed cannabis regulations that are right now under review by the California Office of Administrative Law (OAL). The Bureau’s rulemaking action regarding these regulations, initially noticed on July 13, 2018, was submitted to OAL for review on December 3, 2018. The proposed regulations […]

Updated SOP templates now available for Colorado

What better way to start your new year than by using SOP templates that comply with Colorado’s new marijuana rules? While most of us were sipping champagne and celebrating the New Year, Colorado’s updated marijuana rules went into effect. In a recent blog post, we pointed out the most significant changes to rules. Most notably, […]

Your cannabis business should have New Year’s resolutions too

If you’re anything like me, coming up with New Year’s resolutions for yourself (and sticking to them, for that matter) is just so … blegh. For cannabis business owners, though, some healthy 2019 resolution-reflection time can go a long way in setting up a great year. …But what should those goals be? I’m so happy […]

3 cannabis industry predictions for 2019

It’s hard to make cannabis industry predictions, but some of the largest markets in the world will open for business in 2019. Billion dollar industries are on the horizon in places like New York City and Chicago. And, most importantly, the federal government is poised to enact cannabis reform. Here are three cannabis industry predictions […]

Federal legalization! What if we copied Canada?

As many know, our neighbors to the north recently legalized cannabis nationwide. However, many don’t know exactly how their system works, or how it would look if applied to the United States. We’ve already looked at what federal legalization in the US might look like, so here we’ll take a deep dive into the Canadian […]

Cannabis industry: Same frustration, different states

We all know the cannabis industry is a rapidly changing, and more often than not, a frustrating industry to be involved in. Laws vary by state, and even within one state can vary greatly at the local level as well. Legalization comes in many forms, and these differences can drastically affect businesses and consumers alike. […]

Cannabis and crickets: Trump AG nominee Barr’s silence on marijuana

So who’s the new AG nominee? As someone involved in the cannabis industry, my response this morning to hearing that President Trump had announced William P. Barr as his Attorney General (AG) nominee was pretty standard. In fact, it was the same thing I’d done a few years before, with great results, when Trump had […]

2019 marijuana rules: nasal spray, weed lube, and butt pot, oh my!

On November 9, Colorado’s Marijuana Enforcement Division (MED) announced that the 2019 marijuana rules have been adopted. For a Regulatory Analyst at Simplifya, that kind of news means it’s time to hunker down with 500 pages of redlined rules and figure out what our clients will have to change on January 1. FUN! More than […]

Mitigating Metrc Risk

There are many unique aspects to cannabis regulation, none more fraught with risk than inventory management. We’re not aware of any industry that is required to track its inventory on a government mandated database through every single phase of the supply chain. Imagine a hops farmer, brewer, and liquor store all being required to report […]

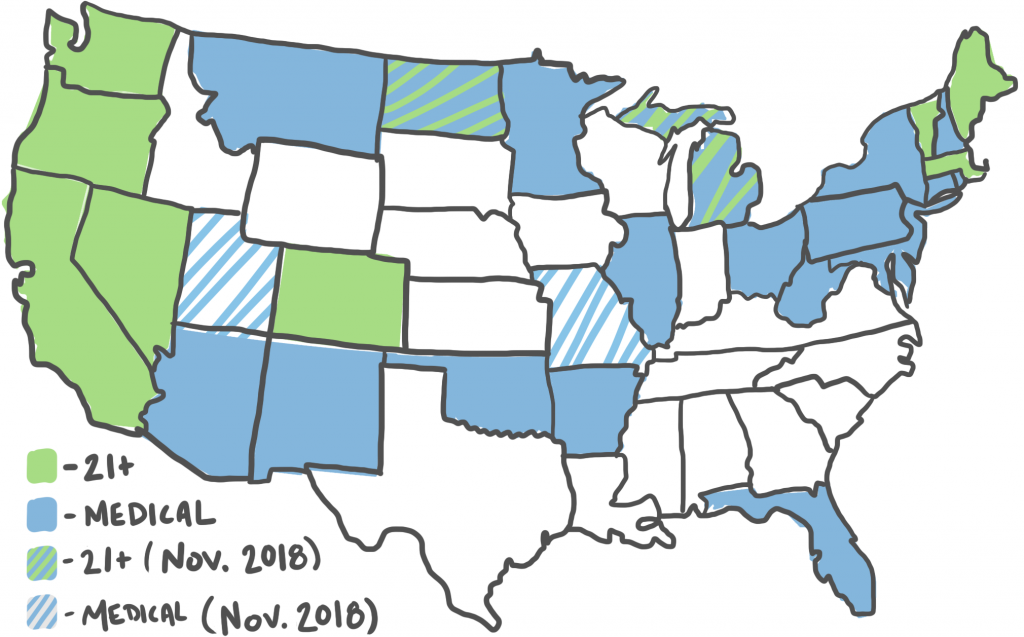

Marijuana midterm results 2018

The 2018 midterm results are in and there were some big wins regarding marijuana initiatives. So what were the highlights? We can all agree that Michigan becoming the 10th state to legalize recreational marijuana is big news. In addition, Missouri and Utah became the 31st and 32nd states to legalize medical marijuana. Congrats! Let’s take a […]

Licensing in Massachusetts? You must pass inspection first!

Licensing in Massachusetts Licensing in Massachusetts is heating up, as the Cannabis Control Commission (CCC) has granted final licenses. Dispensaries, cultivators, manufacturers, and testing labs have received licenses in the past month. A common requirement in the US is that cannabis must be tested before stocking it on shelves. Retailers in Massachusetts were waiting on testing labs just last week […]

Cannabis ballot measures to watch on November 6th

As the midterm elections loom, several states across the US have cannabis ballot measures to vote for. Here at Simplifya, we’ll be watching the results closely, ready to cover all things compliance. We cover any state that gives the green light to cannabis. In light of the upcoming election, we thought we’d give a quick […]

My favorite weird marijuana regulations

So you want to know about weird marijuana regulations As we all know (hopefully), marijuana is illegal under federal law. In spite of that law, 30 states now allow the sale of marijuana in some capacity. Except for a few short memos from the U.S. Attorney General’s office, states have little guidance on how to […]

8 new Simplifya features you might have missed

We pride ourselves on moving fast here at Simplifya, and sometimes we move so fast it becomes easy to miss a new bit of functionality here, a new and improved interface there. That’s why we’re circling back to make sure you saw some of the biggest new Simplifya features and improvements from the last few […]

Colorado’s top cannabis regulator reveals his insight into the industry

Link to full interview here — In order to be successful, cannabis companies must traverse a patchwork of state and local regulations while also remaining competitive in a steadily growing marketplace. They frequently have to make complex business decisions, often aimed at achieving compliance while minimizing disruption to their optimal operating procedures. One of the many […]

California should follow Colorado’s lead on packaging and labeling

Earlier this month, the two largest cannabis markets in the country, Colorado and California, underwent some pretty significant regulatory changes. Colorado adopted an entirely new set of packaging and labeling requirements (again!) late last year and expected compliance on July 1, 2018. California required its cannabis products to be tested, packaged, and labeled immediately following its […]

7 new Simplifya features you might have missed

We pride ourselves on moving fast here at Simplifya, and sometimes we move so fast it becomes easy to miss a new bit of functionality here, a new and improved interface there. That’s why we’re circling back to make sure you saw some of the biggest new Simplifya features and improvements from the first half […]

Five things to know as California’s transition period comes to an end

California’s adult use cannabis market has been up and running for about six months now. It has been nothing short of a complicated transition for businesses and regulators alike. All eyes are still on the state as it builds the foundation for what is expected to be the biggest cannabis market in the nation. At […]

Say What?! How cannabis business employees communicate with the community

Budtenders at licensed cannabis dispensaries are in a role similar to other retail jobs. You are expected to have knowledge of the products, awareness of what’s new and what’s on special, and the ability to communicate that info to inquiring customers. But there are some aspects of the job that are unlike many others. In […]

Automated SOPs make compliance a breeze

Good news, everyone! Simplifya now offers templates for state-required Standard Operating Procedures (SOPs) in California! Not only that, we offer a variety of additional SOPs that cover best practices for many different license types. Simplifya SOPs You may be wondering, “Why do I need SOPs from Simplifya if I already have my own?” Simply put, […]

Regulators reveal most common compliance issues, part 2

If you’re keeping up with our blog, then you already read Regulators reveal most common compliance issues, part 1. Here’s part 2! Coincidentally, here’s another article about how the Department of Cannabis Control (DCC) is ramping up enforcement efforts to squash unlicensed cannabis businesses. But the Department isn’t only looking for unlicensed businesses. They are […]

California regulators coming! Be prepared!

As California regulators continue to implement its complex system, we are seeing the first real regulatory audits of cannabis businesses. With that in mind, the hard-working folks over at Simplifya are launching a new initiative to help California cannabis businesses (and their brethren across the country) prepare for – and handle – regulatory audits. Starting […]

Regulators reveal most common compliance issues, part 1

Compliance issues are common in California’s newly regulated cannabis industry, which is no surprise given the complexity of the state’s regulatory landscape. Enforcement has been ramping up after the state’s emergency regulations went into effect on January 1, with regulators assailing unlicensed cannabis businesses and conducting inspections of those that have received licenses to make […]

MAUCRSA drives complex regulatory landscape in California

Are you wondering why the regulatory landscape for cannabis in California is so complex? Look no further than the Medicinal and Adult-Use Cannabis Regulation and Safety Act (MAUCRSA)! MAUCRSA California first regulated cannabis businesses in 2015 when it enacted the Medical Cannabis Regulation and Safety Act (MCRSA). Previously, most collectives and nonprofits were operating without […]

Enforcement on the rise in California

Roughly two months after the adult-use cannabis market opened in California, regulators have started to ramp up enforcement and perform compliance checks across the state. Officials want to weed out California’s unlicensed cannabis companies. They certainly have their work cut out for them. The California Bureau of Cannabis Control (BCC) sent out more than 900 […]

Improving the readability of our audit content

We recently executed “Operation Easy Read” with the goal of improving the readability of our audit content. “Not written in layperson terms” and “too much legal jargon” were consistent pieces of feedback. We took it upon ourselves to review every question and action item. We forced ourselves to find shorter ways of saying things, remove […]

How to prepare for an inspection

The Cannabis Business Times recently published an interesting article with tips on how to prepare for a regulatory inspection. The tips come from Rino Ferrarese, Chief Operating Officer of Connecticut Pharmaceutical Solutions, and serve as a reminder that at some point your products or your business will be inspected – and the consequences of not passing can be dire. […]

The importance of compliance in the post-Cole Memo era

The entire cannabis industry received a bit of a shock on January 4, when U.S. Attorney General Jeff Sessions rescinded the Cole Memo and four other similar memos that had guided Department of Justice enforcement priorities related to cannabis since 2009. These memos had set forth a policy under which the Department would not prioritize […]

Simplifya: What we built in 2017 (and what’s in store for 2018)

With 2017 in the books, we’re taking a look at the growth of Simplifya over the past year. We made some huge leaps in how we helped businesses stay on the right side of the law, and learned even more about how we’re going to approach this exhilarating and ever-growing market. California and beyond. More […]

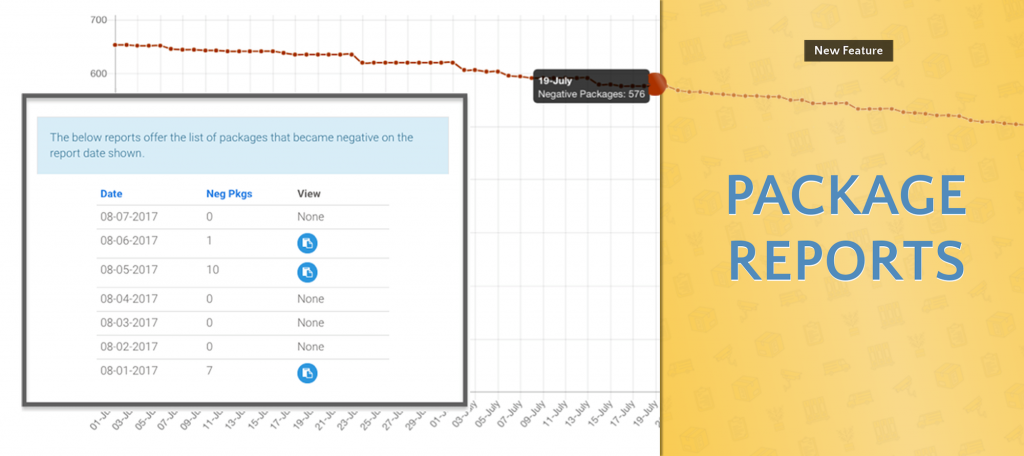

Introducing the Old and Negative Package Reports

Not long after joining the ranks of Metrc validated integrators earlier this year, we began ideating ways we could make our clients smarter (and more compliant) with their seed-to-sale data. After a couple months of planning, building, and revising, we’re ecstatic to unleash the first two reports in a new module we call “Analytics”. Old […]

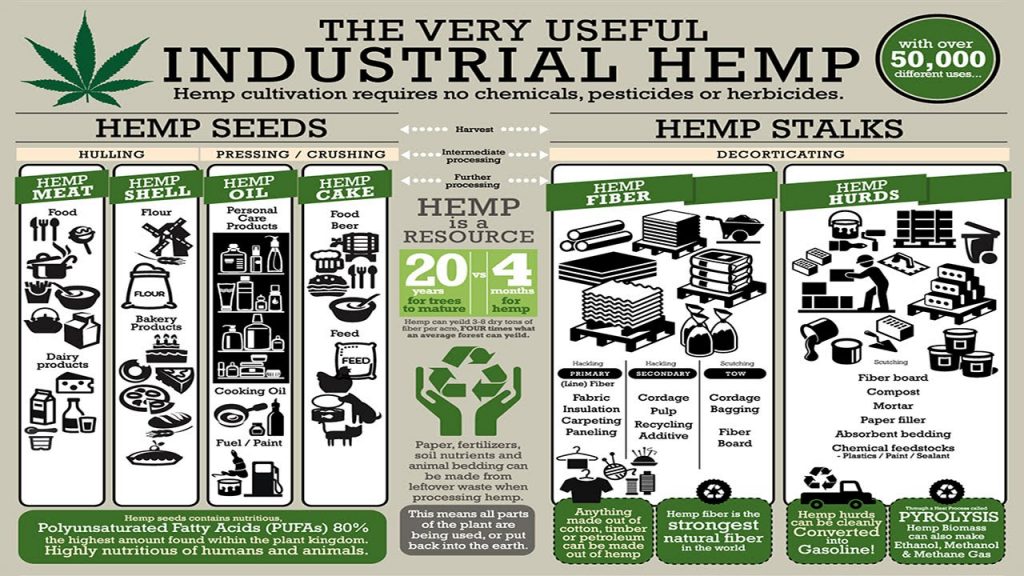

Protecting water rights for hemp farmers

Last week, I got an email blast from Senator Cory Gardner (R-CO) and one of the updates was about protecting water rights for hemp farmers. I’ve always been curious about where the hemp and marijuana industries differ and overlap, so I took the click bait. Here’s an excerpt: A pilot program created by the 2014 […]

Hickenlooper’s advice to marijuana businesses

Colorado Governor John Hickenlooper was recently interviewed on Meet The Press with Chuck Todd. Though nearly lost amidst all of the buzz surrounding Trump’s one-page tax plan, there are some interesting takeaways that Colorado marijuana businesses especially should note. The full nearly-10 minute interview covers several topics, but the early focus is Hickenlooper’s summary of a meeting […]

Progress amidst uncertainty

In the cannabis world, a constant theme is uncertainty. I suppose the theme persists in any relatively new industry, but the uncertainty becomes a little bit more palpable each day that passes without any sort of clear stance on legalization from the Trump administration. Below are three tidbits of information that assuage the discomfort of […]

Denver’s Initiative 300 faces immediate setback

The success of Denver’s Initiative 300 is facing a serious setback courtesy of a new regulation from the Colorado Department of Revenue that expressly prohibits consumption of marijuana at any place that has a liquor license. Translation: you won’t be able to legally smoke up at a bar in Denver, even though Initiative 300’s passage […]

The compliance officer’s dilemma

Culture of Compliance The true measure of success for a compliance officer lies in creating a culture of compliance that permeates the organization. He needs to make every employee a compliance officer of sorts, and the greater his degree of success in doing so, the less the need for any one individual with "compliance" in [...]

Simplifya launches groundbreaking cannabis compliance software in Colorado

Denver-based company helps local marijuana businesses stay compliant with complex industry regulations November 15, 2016 DENVER, CO – Today, Simplifya launched its highly anticipated software, making it easier for businesses, law firms, consultants, financial institutions and regulatory agencies to monitor cannabis licensee operations for compliance with state and local regulations. Some of Colorado’s most recognized […]

Simplifya completes Series A funding

Hypur Ventures leads investment in cannabis tech company September 22, 2016 SCOTTSDALE, AZ – Simplifya, a portfolio company of Hypur Ventures, announced today that it has completed its Series A capital financing stage. Simplifya is a software company operating in the legalized marijuana industry that assists businesses, law firms, consultants, financial institutions and regulatory agencies […]