The Leading And Longest-Running Regulatory And Operational Compliance Software Company In The Cannabis Industry

Trusted by the largest MSOs and smaller operators alike

In a highly regulated industry like cannabis, compliance is essential for the most valuable asset in any cannabis business – the license to operate.

“Operational compliance,” as the phrase implies, covers all of the regulations related to operating your business. Depending on your license type, the scope includes everything from checking IDs at the door to keeping video surveillance recordings to buying seeds and more. Don’t be fooled into thinking your business is compliant just because your POS or S2S system is compliant. Those areas are important, but they are focused on specific subsets of the regulations. Operational compliance is comprehensive, and that’s what is needed to maintain a license in good standing.

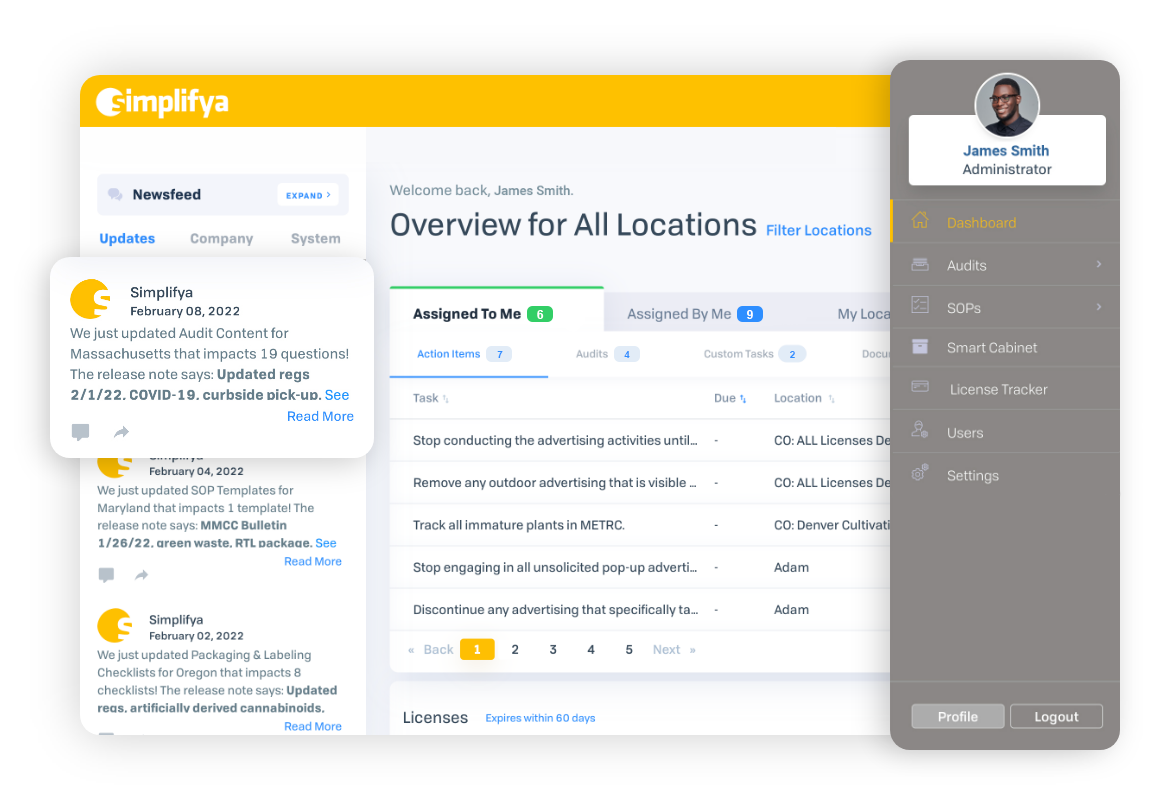

Established in 2016, Simplifya is the leading and longest-running operational compliance software company in the industry. We streamline complex regulations and deliver value through easy-to-use technology. We are trusted by the largest MSOs and smaller operators alike because at the end of the day, protecting a license means ensuring operational compliance.

In a highly regulated industry like cannabis, compliance is essential for the most valuable asset in any cannabis business – the license to operate.

“Operational compliance,” as the phrase implies, covers all of the regulations related to operating your business. Depending on your license type, the scope includes everything from checking IDs at the door to keeping video surveillance recordings to buying seeds and more. Don’t be fooled into thinking your business is compliant just because your POS or S2S system is compliant. Those areas are important, but they are focused on specific subsets of the regulations. Operational compliance is comprehensive, and that’s what is needed to maintain a license in good standing.

Established in 2016, Simplifya is the leading and longest-running operational compliance software company in the industry. We streamline complex regulations and deliver value through easy-to-use technology. We are trusted by the largest MSOs and smaller operators alike because at the end of the day, protecting a license means ensuring operational compliance.

Alyssa Clemmer

Compliance Specialist

Tyler Burke

Director of Corporate Compliance

Wesley Hein

Head of Legal, Public Affairs

Risk Mitigation Alliance (RMA) is a partnership between Simplifya and the top insurance companies, law firms, banks, HR, and payroll companies in the cannabis industry, designed to reduce the risk of insuring licensed cannabis operators and to provide operators with a cost-effective means to manage their regulatory compliance. Visit our Risk Mitigation Alliance page and find out if you qualify for preferred pricing or discounts!