California has received more than its fair share of attention from cannabis industry participants since launching its adult-use program in 2018. However, as California licensed operators struggle to operate in the state’s heavily regulated market that imposes crippling taxes while competing against illicit operators, industry insiders are starting to focus their sights on the tri-state area, where New Jersey, New York, and Connecticut are seeking to build upon the success neighboring states have experienced after launching adult-use cannabis sales. Leveraging lessons learned from other states that have already implemented recreational cannabis programs, New Jersey, New York, and Connecticut, with their close geographical proximity, hope to avoid some of the pitfalls that have plagued other markets in order to create efficiencies that lower costs of operation, increase sales, and ultimately benefit patients, consumers, business owners, communities, and state coffers.

Whether these efficiencies will materialize remains to be seen, because the differences in each state’s regulatory framework, including the regulations promulgated by different licensing authorities, and high tax rates, may ultimately create roadblocks that prevent an open market. Nevertheless, by understanding the marketplace and knowing the rules and regulations that govern the tri-state area, applicants, licensed operators, and those that service cannabis-related businesses can try to create efficiencies internally while facing the external challenges that are seemingly out of their control.

Below is summary information obtained from the Simplifya Market Guide that provides some tri-state marketplace insights needed to help create a sustainable business plan for operating a cannabis-related business in New Jersey, New York, and/or Connecticut. Market participants may have to take a “wait and see” approach while the area waits to see the effects of each state’s regulations and taxes. Hopefully, legislators and regulators are watching as well, so that any needed changes can be made to make the tri-state market successful in the quickest way possible.

New Jersey

Insights

New Jersey voters approved legalization in November 2020, and legislators passed the New Jersey Cannabis Regulatory, Enforcement Assistance, and Marketplace Modernization Act (CREAMM Act) in February 2021. The Act enables medical operators to transition to serve adult-use while the state Cannabis Regulatory Commission (CRC) opens application rounds for cultivation, manufacturing, retail sales, microbusinesses, and other license types. Initial cultivation licenses are limited to 37 for the first two years, there are no limits on microbusiness cultivators or any other license type. Adult-use cannabis sales began on April 21, 2022, with 12 dispensaries selling to more than 12,000 adult customers that day. Within the first month, New Jersey had recreational sales of more than $24 million, and the state is anticipating increased sales as more medical licensees are approved to sell recreational cannabis.

Tax Rates for Recreational Cannabis

In New Jersey, adult-use cannabis sales are subject to state and local taxes. In addition to the state sales tax of 6.625% paid by consumers, cannabis growers will be subject to a gradually increasing excise tax. For the first nine months of legal sales, the tax will be 33% of 1% of the average retail price per ounce. Thereafter, the tax will depend on the cost per ounce of cannabis, as follows:

- $10 per ounce if average retail price per ounce is above $350;

- $30 per ounce if average retail price per ounce is between $250 and $350;

- $40 per ounce if average retail price per ounce is between $200 and $250; and

- $60 per ounce if average retail price per ounce is below $200.

New Jersey municipalities can also enact by ordinance a local cannabis tax that may not exceed 2% for cannabis cultivators, manufacturers, and/or retailers; and 1% for wholesalers. The tax percentage is based on the receipts for each sale and must be paid directly to the municipality.

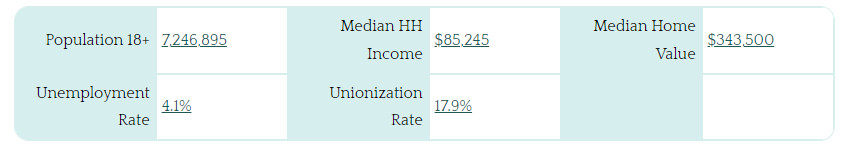

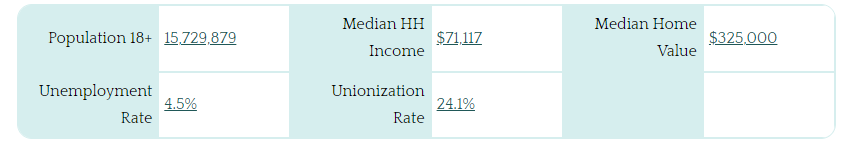

General Data Points

License Types & Structure

Medical: The following types of medical licenses are allowed pursuant to the CREAMM Act: ATC (vertically integrated operator), cultivator (grow and wholesale), manufacturer (produce), dispensary (sell and deliver), clinical registrant (vertically integrated ATC holding a contract with a qualifying academic medical center in the region for clinical research), and integrated curriculum license (ATC holding partnered with an approved academic, clinical, or research program at an institution of higher education).

There are currently 12 Alternative Treatment Centers and satellite locations across New Jersey serving New Jersey’s medicinal cannabis patients. The CRC has accepted the recommendation to approve 14 of the 2019 medicinal cannabis business applications that had been previously held up due to a court-ordered stay of the review process. Ten applications for cultivation permits and four applications for vertically integrated permits were approved and can begin preparations to serve New Jersey’s medicinal cannabis patients. Because of increasing patient need, five more cultivation permits were awarded than had been planned in 2019. Of the ten cultivator permits approved, three are in North Jersey, five are in Central Jersey, and two are in South Jersey. They could potentially add 235,000 square feet of canopy to the market. The four vertically integrated awards (for businesses doing cultivation, manufacturing, and retail) could add another 120,000 square feet of cannabis canopy and an additional four retail locations.

Adult Use: The following six classes of license types are available for personal-use licensed businesses under the CREAMM Act: Class 1-Cultivator (grow), Class 2-Manufacturer (produce), Class 3-Wholesaler (buy, store, sell, or otherwise transfer personal-use cannabis items between cultivators, manufacturers, wholesalers, and retailers), Class 4-Distributor (transport cannabis in bulk between cultivators, manufacturers, wholesalers, and retailers), Class 5-Retailer (purchase personal-use cannabis and sell to consumers), and Class 6-Delivery (transport consumers’ purchases from retailer to consumer).

Applicants may apply for an annual license, a conditional license, or a microbusiness license. Conditional and microbusiness licenses are available for the following classes of licenses: medical cultivator, medical manufacturer, medical dispensary, and all adult-use license types (i.e., Class 1 – Class 6).

Currently operating ATCs will not be required to submit a full application to start participating in the recreational cannabis space. Companies will need to notify the CRC of the company’s intent and prove that they have adequate supply to meet the reasonably anticipated needs of medicinal cannabis patients. They will also need to get approval from the municipalities where they are located.

Microbusinesses must meet all of the following requirements: have no more than 10 employees; have premises of no more than 2,500 square feet; and in the case of a cannabis cultivator, the canopy height cannot be more than 24 feet; possess no more than 1,000 cannabis plants each month (cannabis distributors are exempt); and acquire no more than 1,000 pounds of usable cannabis (or the equivalent amount in other forms) each month.

A conditional license permits the holder to begin building out operations for the respective license type while working toward satisfying statutory and regulatory conditions for an annual license.

License Counts

Medical: There are currently 12 separate entities with active licenses. Most entities possess multiple licenses.

- Cultivation: 10

- Processing: 13

- Retail: 21

Adult-Use: Class 5 Retailer – 13

Licensing Rounds

Medical: On Dec. 7, 2021, New Jersey regulators approved 30 new licenses to companies that will sell medicinal marijuana, more than doubling the number of retail locations for a growing pool of patients who for years complained about long commutes to obtain legal cannabis.

Adult Use: The CRC began accepting the following applications for personal use (recreational) cannabis on Dec. 15, 2021:

- Class 1-Cultivator Licenses

- Class 2-Manufacturer Licenses

- Testing Laboratories

Application acceptance for Class 5-Retailers began on March 15, 2022.

On April 11, 2022, the CRC approved applications from seven Alternative Treatment Centers to expand into the recreational cannabis business. In addition to the ATC expansions, the CRC also approved 34 conditional license applications for cultivators and manufacturers. This brings the number of conditional licenses approved so far to 102.

Equity Licensing Structure

Medical: Prior licensing rounds have awarded additional points to entities that have received a Minority Business Enterprise (MBE), Women Business Enterprise (WBE), or Veteran Owned Business designation. CRC is in the process of establishing rules that will govern the application process for medical cannabis permits in the future.

Adult Use: The CREAMM Act established an Office of Minority, Disabled Veterans, and Women Cannabis Business Development at the CRC (also referred to as the CRC’s Office of Diversity and Inclusion), which shall establish and administer unified practices for promoting participation in the medical and personal-use cannabis industry by persons from socially and economically disadvantaged communities. (See N.J.S.A. 24-6I-25). The effectiveness of the measures will be assessed by considering whether the measures have resulted in not less than 30% of the total number of licenses being issued to minority, women, and disabled veteran-owned businesses, and further assessed by considering whether they have resulted in not less than 15% of the licenses being issued to certified minority businesses, and not less than 15% to certified women’s and disabled veterans’ businesses. A “social equity business” is defined by the CRC regulations as a license applicant or license holder that meets one of the following criteria:

- More than 50% of the ownership interest of the license applicant or license holder is held by one or more persons that demonstrate one of the following criteria: a) At the time the initial application is submitted, have lived in an economically disadvantaged area for five of the 10 preceding years; and b) Are, at the time the initial application is submitted and based on the preceding year’s income, a member of a household that has a household income that is 80% or less of the average median household income in the state, as determined annually by the U.S. Census Bureau.

- More than 50% of the ownership interest of the license applicant or license holder is held by one or more persons who are eligible to be pronounced rehabilitated in accordance with N.J.A.C. 17:30-7.12(e), if necessary, and have been adjudicated delinquent for or convicted of, whether expunged or not, in New Jersey, another state, or the federal government: a) At least two marijuana- or hashish-related disorderly persons offenses; or b) At least one marijuana- or hashish-related indictable offense.

New York

Insights

After years of deliberating, the New York legislature passed, and former Gov. Andrew Cuomo signed, the Marijuana Regulation and Taxation Act on March 31, 2021. While this new law kicked off significant excitement within the industry and advocacy communities, Gov. Cuomo did not submit nominees for the Cannabis Control Board (CCB) and Office of Cannabis Management (OCM) before the Senate adjourned in June. This delay was resolved when scandals forced the former governor to resign, and newly ascended Gov. Kathy Hochul had appointments for chair of the CCB and director of the OCM approved during a special session on Sept. 1. With limited medical businesses to transition to adult-use, just 10 vertically integrated operators and 38 dispensaries, the OCM will need to license hundreds of businesses to reasonably capture existing demand. As such, New York’s success will depend on its ability to avoid litigation and quickly license cultivators, manufacturers, and retailers throughout the state and New York City.

Tax Rates for Recreational Cannabis

New York’s approach to taxing recreational cannabis differs from New Jersey’s. For adult-use cannabis products sold by a distributor to a person who sells such products at retail, tax rates are based on the amount of total THC, as reflected on the product label:

- Cannabis flower: $0.0005 per mg of the amount of total THC;

- Concentrated cannabis: $0.0008 per mg of the amount of total THC; and

- Cannabis edible product: $0.03 per mg of the amount of total THC.

There is also an additional state sales tax of 9% of the amount charged to a retail customer, and an additional local sales tax of 4% of the amount charged to a retail customer. This local tax is distributed to local governments based on location. 25% of the local sales tax revenue goes to the county, and 75% goes to the municipalities within the county as a proportion of cannabis sales. See MRTA § 493.

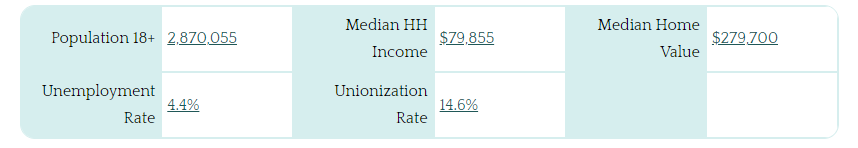

General Data Points

Licensing Type & Structure

Medical: New York’s medical marijuana law, the Compassionate Care Act (CCA), authorized 10 vertically integrated registered organizations (ROs).

Adult Use: MRTA outlines 11 different types of adult-use licenses: adult-use cultivator, adult-use nursery, adult-use processor, adult-use distribution, adult-use cooperative, adult-use microbusiness, adult-use retail dispensary, adult-use on-site consumption, adult-use delivery, registered organization adult-use cultivator processor distributor retail dispensary, and registered organization adult-use cultivator processor distributor.

Licensing Counts

Medical

- Registered Organizations: 10

- Dispensing: 40

- Manufacturing: 10

- Laboratory: 4

Adult Use

- Conditional Cultivator: 162

Licensing Rounds

Medical: July 2015 and August 2017; additional medical licensing rounds are anticipated once MRTA is fully implemented.

Adult Use: On April 14, 2022, the Board approved 52 conditional cultivation licenses to be granted to hemp businesses. More than 150 applications have been submitted, and remaining applicants will continue to be reviewed on a rolling basis. Other adult-use licensing rounds are anticipated in mid-2022.

Equity Licensing Structure

Medical: Neither the CCA nor the existing medical use regulations include any provisions addressing equity licensing.

Adult Use: The stated goal is to award 50% of adult-use licenses to social and economic equity applicants and ensure inclusion of individuals from disproportionately impacted communities and diverse individuals. Furthermore, New York intends to reserve its first retail licenses to sell marijuana for people convicted of marijuana-related offenses, or their relatives.

Connecticut

Insights

Connecticut has a moderately sized medical cannabis program with 18 dispensaries and just 4 producer licenses. On June 22, 2021, Gov. Ned Lamont signed adult-use legalization into law, with the program first coming into effect on July 1. While Connecticut, New Jersey, and New York all legalized cannabis in the same year, it may take Connecticut longer than the remaining tri-state area to implement adult-use sales. Betting on its own program, the State of Connecticut invested in the cannabis edibles company 1906. The Governor’s office aims to start adult-use cannabis sales by the end of 2022. Home cultivation will not be permitted until July 2023. In the meantime, Connecticut residents who have not registered as patients will not yet be able to obtain adult-use cannabis products in the state.

Tax Rates for Recreational Cannabis

There will be three taxes on retail sale of recreational cannabis: the state’s usual 6.35% sales tax, a 3% sales tax dedicated to the city or town where the sale occurs, and a tax based on THC content that will cost approximately 10-15% of the sale price. In total, the tax rate is expected to be approximately 20% of the retail price of cannabis.

General Data Points

Licensing Type & Structure

Medical

- Dispensary Facility. A place of business where marijuana may be dispensed, sold, or distributed in accordance with Section 21a-408-35 of the Regulations of Connecticut State Agencies to qualifying patients and primary caregivers and for which the department has issued a dispensary facility license to an applicant under Senate Bill no. 1201 (“the Act”) and Section 21a-408-14 of the Regulations of Connecticut State Agencies. RCSA Sec. 21a-408(8)

- Licensed Producer. A person who is licensed as a producer pursuant to RCSA Sec. 21a-408(9)

Adult Use

- Retailer. May obtain cannabis from a cultivator, micro-cultivator, producer, product packager, food and beverage manufacturer, product manufacturer, or transporter. May make deliveries either through a delivery service or employees.

- Hybrid Retailer. A person who is licensed to purchase cannabis and sell cannabis and medical marijuana products.

- Cultivator (cultivates 15,000 square feet or more). May label, manufacture, package, and perform extractions on any cannabis they grow or propagate at their licensed establishment. May sell, transfer, and transport cannabis to all other types of licensed facilities on this list, but cannot sell, transfer, or deliver to consumers or patients.

- Micro-Cultivator (between 2,000 and 10,000 square feet). May label, manufacture, package, and extract cannabis that they cultivate and grow at their own licensed facility. May sell, transfer, or transport cannabis to all other facilities and consumers as long as they use their own employees or delivery service. May expand annually in 5,000-square-foot increments (up to 25,000 square feet) as long as the expansion meets certain requirements and Connecticut Department of Consumer Protection determines it is allowed.

- Product Manufacturer. May perform cannabis extractions, chemical synthesis, and all other manufacturing activities as allowed per DCP. May package and label cannabis manufactured at their establishment subject to their license. Cannot sell to or deliver directly to consumers.

- Food and Beverage Manufacturer. May incorporate cannabis into food and beverages as an ingredient. Cannot sell directly to consumers. Cannot extract cannabis into a cannabis concentrate or create any product that is not food or beverage intended for human consumption.

- Product Packager. May obtain cannabis from a Producer, Cultivator, Micro-Cultivator, Food and Beverage Manufacturer, or Product Manufacturer. May sell, transfer, or transport cannabis to cannabis businesses, laboratories, or research programs, as long as the cannabis was packaged at their own facility.

- Delivery Service or Transporter. Applicant must indicate if they are applying to transport cannabis between establishments or from certain establishments to consumers or patients. Delivery Service licensees cannot store or maintain control of any cannabis or cannabis products for more than 24 hours from when the consumer or patient places the order.

License Counts

Medical

- Producer: 4

- Dispensary Facility: 18

Adult Use

- None issued yet.

Licensing Rounds

Medical

- Dispensary Facilities: Requests for Applications were held in 2013, 2015, and 2018.

- Producers: Request for Applications was held in 2013.

New licensing rounds are expected from DCP when it launches the Adult Use program.

Adult Use

- Disproportionately Impacted Area Cultivator: Feb. 3, 2022 (non-lottery): Unlimited

- Retailer: Feb. 3, 2022 – 6 general licenses, 6 Social Equity licenses

- Micro-Cultivator: Feb. 10, 2022 – 2 general licenses, 2 Social Equity licenses

- Delivery Service: Feb. 17, 2022 – 5 general licenses, 5 Social Equity licenses

- Hybrid Retailer: Feb. 24, 2022 – 2 general licenses, 2 Social Equity licenses

- Food and Beverage: March 3, 2022 – 5 general licenses, 5 Social Equity licenses

- Product Manufacturer: March 10, 2022 – 3 general licenses, 3 Social Equity licenses

- Product Packager: March 17, 2022 – 3 general licenses, 3 Social Equity licenses

- Transporter: March 24, 2022 – 2 general licenses, 2 Social Equity licenses

Equity Licensing Structure

Medical

Not expressly addressed.

Adult Use

Connecticut has created the Social Equity Council, which is tasked with establishing criteria to study the effects of the war on drugs and using data to create an equitable program going forward.

The legislation also allowed for record expungement of prior possession charges for fewer than four ounces. Individuals may begin to petition on July 1, 2022. Beginning Jan. 1, 2023, there will be an automatic erasure of convictions from Jan. 1, 2000, through Sept. 15, 2015.

DCP must reserve 50% of the maximum number of applications for social equity applicants.

Social equity applicants receive 50% reduction of license fees for the first three renewal cycles. A “social equity applicant” is defined as an applicant for a cannabis establishment license that is at least 65% owned and controlled by one or more individuals, or such applicant is an individual who 1) had an average household income of less than 300% of the state median household income over the three tax years immediately preceding such individual’s application and 2) lived in a disproportionately impacted area for either at least five of the past 10 years or nine of their first 17 years of life.

The DCP opened a three-month application period on Feb. 3 for social equity applicants to apply for provisional cultivator licenses in a disproportionately impacted area. These applicants shall be granted if the applicant pays a $3 million fee to the Social Equity and Innovation Fund.

The Act also creates a cannabis business accelerator program where social equity licensees will partner with a cannabis establishment to provide technical training and assistance. A workforce training program will be created to provide access to an employee applicant pool and help disproportionately impacted individuals find employment in the cannabis industry. There will be $50 million in bonding for initial funding for start-up capital for social equity applicants, the cannabis business accelerator program, and workforce training.

Applications were accepted beginning Oct. 1, 2021, for retailers, cultivators, product manufacturers, food and beverage manufacturers, and product packager accelerator program applicants.

Applications may be accepted beginning July 1, 2022, for the above five license types as well as hybrid retailers and micro-cultivators.

By Katrina Skinner, General Counsel & Chief Banking Officer and Katelin Edwards, Senior Regulatory Analyst